- admin

- November 21, 2024

Navigating the financial complexities of running a small or medium-sized business can be challenging, especially when resources are stretched thin. Virtual accounting services offer a cost-effective solution by managing your finances with precision and professionalism. This article explores seven key ways these services can lead to significant savings for your business, enhancing both efficiency and profitability.

Small Medium Businesses need to plan their financials wisely and cannot block a major chunk of their revenue or capital in overheads and operational costs. Most of it at this stage should be going into acquiring new businesses while retaining the old ones. This is where these 7 ways virtual accounting services can save your small medium business huge money.

Virtual accounting services governed by streamlined processes such as those at Encox Services INC provide a substantial reduction in the overhead costs associated with traditional in-house accounting departments. When you outsource your accounting needs, you can eliminate the expenses tied to employee salaries, benefits, workspace and technology. This not only decreases your operational costs but also allows for more flexibility in financial planning.

Not only that you are paying for an experienced professional but due to exchange rate disparities, you are paying them a fair price in their currency while receiving superior work in return compared to paying two times the cost in home currency.

Save on the high costs of salaries, health benefits, and other employee-related expenses.

Reduce or eliminate the need for office space dedicated to accounting staff.

Avoid the cost of purchasing and updating accounting software and equipment.

Reduce expenses related to training and updating personnel on the latest accounting standards and technology.

These savings can be redirected towards strategic investments, driving growth and innovation in core business areas. In fact, you can go for a retainer model or a project model depending on your specific needs, budget and time constraint. This flexibility allows you greater freedom to grow your small medium business at a faster pace. In addition, our offshore accounting services for small medium businesses are scalable.

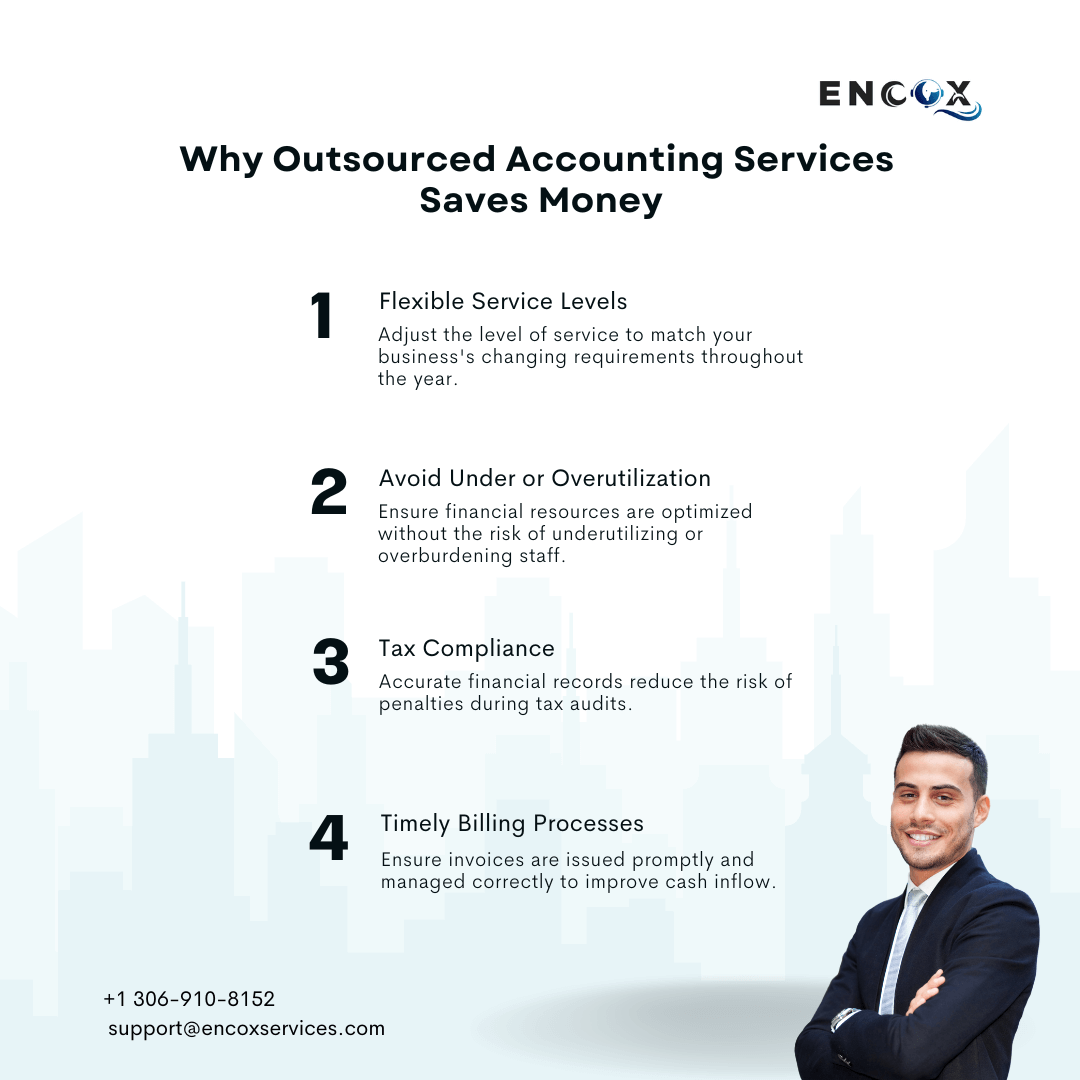

Adaptability is crucial for growing businesses and virtual accounting services at Encox center around providing scalable solutions that adjust to your business’s financial activity. Whether it is expanding during peak seasons or scaling down during slower periods, these services ensure you only pay for what you need, without the fixed costs of in-house staff. With Thanksgiving Season just around the corner and Happy Holidays echoing through office hallways, most businesses including Accounting Firms need the assistance of affordable, experienced and professional offshore accounting services.

This is what it means when we say we offer Scalable Offshore Accounting Services that suit the Holiday Season:

Adjust the level of service to match your business’s changing requirements throughout the year.

Choose from a variety of service packages that align with your budget and financial management needs.

Scale services without the typical overhead associated with expanding an in-house team.

Ensure financial resources are optimized without the risk of underutilizing or overburdening staff. This flexibility ensures that your accounting services can grow alongside your business, providing support exactly when it’s needed.

Adaptability and scalability is not only a part of the process design of how we serve our clients and customers, but it is also a practice of delivering best outcomes in good faith. At the end of the day, we want our clients to be associated with us for the long haul and that is precisely why we act in good faith and strive to balance holiday work loads and tax season workloads accordingly. Ultimately, it is all about delivering results with enhanced financial accuracy without burning a hole in your pocket.

Outsourced accounting services offered at Encox focus entirely on ensuring financial accuracy for your business, especially with increasing regulatory demands and the need for timely business intelligence. Our outsourced accounting services employ highly skilled professionals who use advanced tools to ensure that your financial records are meticulously maintained, which is essential for compliance as well as clear strategic decision-making.

This enhanced financial accuracy leads to:

Leveraging experienced professionals minimizes the risk of costly errors.

Ensure financial statements and reports are accurate and timely.

Accurate financial records reduce the risk of penalties during tax audits.

Rely on expert advice for financial decisions, ensuring compliance and efficiency.

The precision provided by your virtual accountants can save substantial money in the long run by avoiding fines and enabling better financial planning. In addition, the flexibility of our model of operations combined with years of expertise of our professionals ensure you pay the best value for the tasks assigned. This allows you to streamline your cash flows while at the same time being insightful on planning your capital expenditures for the long term.

Cash flow is the lifeblood of any business, and managing it effectively can be the difference between thriving and merely surviving. Virtual accounting services optimize your cash management practices by streamlining invoicing and collections, managing payables efficiently, and providing accurate forecasting to prevent cash crunches.

These benefits arise from having total visibility of an improved cash flow management powered our expert accounting services:

Ensure invoices are issued promptly and managed correctly to improve cash inflow.

Streamline accounts payable to manage outflows without incurring late fees or penalties.

Regular monitoring helps identify potential cash flow issues before they become problematic.

Use detailed financial analytics to predict future cash flow needs and plan accordingly.

A healthy balance sheet is the sign of a business that is doing well and is positioned to grow. And, our accounting experts help you get there through consistent clarity and support on all accounting matters related to your growing business. In addition, our accountants use a variety of advanced tools including Tally, QuickBooks, NetSuite and more to give you a quick and clear picture of your corporate finances.

Small and medium-sized businesses often struggle to afford the high level of expertise and advanced accounting tools that larger companies enjoy. Virtual accounting services bridge this gap by providing access to expert accountants and cutting-edge technology, enabling your business to benefit from high-level financial strategies and insights

Benefit from the knowledge and experience of seasoned accounting professionals.

Utilize the latest accounting software that comes with robust features without direct investment.

Leverage expert insights for strategic planning and financial optimization.

Access tailored accounting strategies that align with your industry standards and requirements.

This access enables businesses to compete on a level playing field with larger corporations, leveraging expertise and technology to drive growth, not to mention the ample time savings generated which promote a higher rate of return on your accounting investment.

Time is a critical resource in business, and optimizing its use can lead to greater profitability and growth. When you delegate accounting responsibilities to a virtual team, your senior staff can focus on core business strategies and innovation rather than getting entangled in the complexities of financial management.

Automation of routine tasks frees up time for strategic planning.

Redirect internal resources to critical business functions instead of mundane accounting tasks.

Faster retrieval and processing of financial information speed up decision-making.

Minimize downtime associated with accounting functions, keeping the business operations smooth.

Time saved by outsourcing accounting tasks can be significant, allowing senior staff to focus on driving the business forward rather than getting bogged down by financial minutiae. Saving time also gives you ample scope to reduce risk by having enough time to focus on risk management.

In today’s business environment, managing risk is paramount. Our outsourced accounting services help minimize your financial risks through stringent controls, compliance with the latest financial regulations, secure data management practices, and readiness to handle unexpected financial challenges.

Implement controls and checks that reduce the risk of internal fraud.

Stay compliant with financial regulations, avoiding legal repercussions.

Enhance the security of financial data through professional data management practices.

Have expert support in place to manage financial crises effectively. By reducing these risks, virtual accounting services provide peace of mind and ensure the long-term sustainability of your business.

Embracing virtual accounting services can lead to substantial savings for your small or medium-sized business. From reducing overhead costs to enhancing financial accuracy, the benefits are clear and impactful. Entrusting your financial operations to expert virtual accountants lets you to not only save money but also invest in your business’ future.

Are you ready to streamline your financial operations and boost your bottom line? Contact us today to learn how our Virtual Accounting Services can save your business significant amounts of money and help pave the way for financial success.

Share on